Photo Credit: Microlinks

I was part of a recent USAID After Hours Seminar Series (even though this particular one was a breakfast event) sponsored by the Microenterprise Development office on the topic “Viewing Value Chain and Household Finance From a Demand Perspective.”

The discussion was led by Geoffrey Chalmers, a senior technical advisor at ACDI/VOCA and Jason Agar, Director of Kadale Consultants Limited who joined from the UK. The speakers identified among others challenges to the value chain financing from a demand side perspective. These include ‘side-selling’ which acts as disruption for agricultural value chains; enterprises and households facing production, price and market risks; the difficulties involved in obtaining finance for fixed asset; farmers losing value through forced early sale; exploitative power relations between producers and buyers; and weak working capital and cashflow within the value chain.

The speakers cited a case from Malawi where they identified governance structure – open (market based) vs. closed (directed) as one of the causes of side-selling and recommended “hungry season payments” to help farmers meet household demands for food, school fees at times of low income inflow. In Nicaragua, they observed that supervision of the harvesting process and provision of additional services by the union cooperatives and local microfinance institution (MFI) to the farmers could help reduce the side-selling.

So what is Side-Selling in the context of the agricultural value chain financing?

One of the features of the value chain approach to agriculture is the contractual arrangements between firms such as microfinance institution (MFI) and the farmers or producers. Farmers under contract are provided with inputs, training, technical assistance, credit, and other services as well as having a guaranteed market for their produce. These farmers are expected to sell their produce to the financing firm with guaranteed, and most of the time pre-determined price.

But at harvest time when the prices of the produce are higher in the external market compared to the pre-determined price with the financing firm, farmers have an incentive to sell to the spot market instead of selling to the firm that financed them. This practice is known as side-selling or diversion. Side-selling may take forms such as diverting inputs from firms to non-contracted crops; by not adhering to the production schedule agreed upon with the firm; by directly side-selling the produce to other buyers; or by failing to deliver the agreed volume and quality on time.

The root cause of side-selling in Ag Value Chain may be “communication”

So could the challenge with side-selling have anything to do with communication between the actors? If yes, how can the new information and communication technologies (ICTs) help in reducing side selling?

Information asymmetry between two parties in contract such as farmers and MFIs where one party has more or better information than the other could be the root cause for side-selling in agricultural value chains. In this case there is an information gap between the two parties, where farmers have less access to information and poor knowledge of the entire process assumed that there is imbalance of power in transactions and therefore resort to such practices as side-selling.

My personal experience with side-selling, a practice which was referred to as “Diversion” in the cotton industry in Ghana far back in the early 2000, confirms the communication challenge. The cotton sector in Ghana at the time was with little regulation leading to poor or lack of communication among the cotton companies as well as between the companies and the farmers. Farmers took advantage of the situation to defraud the companies through some of the practices associated with side-selling described above.

ICTs and Communication in the Ag Value Chain

Photo Credit: cartoonstock.com

ICTs are “communication tools” that are enabling access to information by rural farmers located in remote communities. These tools are facilitating activities associated with access to inputs by producers, the actual productions process by farmers, marketing and processing by retailers, and monitoring and evaluation of the transaction by the financiers and other donors. Integrating ICTs into the production, marketing, and M&E components of the value chain will ensure rapid flow of information between the stakeholders which will minimize misunderstandings, and allow for risk management, and provide higher levels of transparency.

Creating better communication environment between farmers, input suppliers, and buyers and also among the MFIs or sponsoring companies could reduce side-selling. Specifically, ICTs can be used in some of the following ways to reduce side-selling:

- a) E-vouchers are excellent and more trusted systems for better transactions between farmers and input suppliers and can be integrated into the Ag VC,

- b) Field staffs of MFIs and other firms could integrate ICT solutions into their production processes for precision agriculture that help farmers increase their production thereby minimizing side-selling,

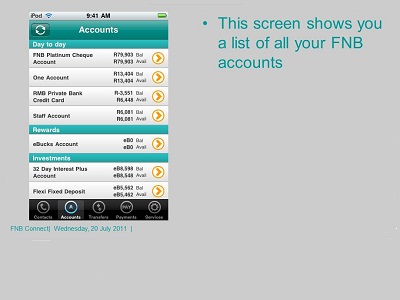

- c) iPad/iPhone applications are widely used now for data gathering and for making policy decisions,

- d) ICTs could be used to gather accurate demographic information about farmers, their farm sizes, produce information on the field before harvest,

- e) Specific traceability applications are being used to monitor produce from the field through to the final destination of consumption thereby minimizing fraud,

- f) Market information systems are now available even in remote communities to get farmers informed of the global market as well as the local market,

- g) With fast data gathering, ICTs can allow farmers to be paid faster to reduce the side-selling for other “urgent” needs,

- h) ICTs can facilitate automated processes at the collection centers to minimize damage of perishable goods and increase the value of the produce for farmers,

- i) Using ICTs to make farmers aware of the dangers and repercussions with side-selling due to improved and accurate data with the MFIs might help reduce side-selling,

- j) ICTs are collaboration tools and could be used to facilitate collaboration among the sponsoring firms and ensure smooth flow of information among them to prevent destructive competition among them. Such competition among MFIs and sponsoring firms enables producers to rob one company for another.

ICTs are not the magic wand to the side-selling challenge with the financing of agricultural value chain. They are technological tools that can be used to catalyze the social processes by the stakeholders to help address the challenge.

Visit here for detailed information and resources on this event and future events by Microlinks.