Rwanda on Tuesday said it had officially launched the third phase of their National Information and Communication Infrastructure Policy aimed at increasing the country’s IT infrastructure and offering new services to its citizens which were established during the first two phases.

Minister in the Presidency managing ICT Ignace Gatare. (image: biztechafrica.com)

The government’s 2000 national ICT plan was created using the four five-year cycle idea in order to gauge where the country was heading and what could be created and established. The first cycle, which ended in 2005, laid the groundwork for the last five years ICT initiatives to be established.

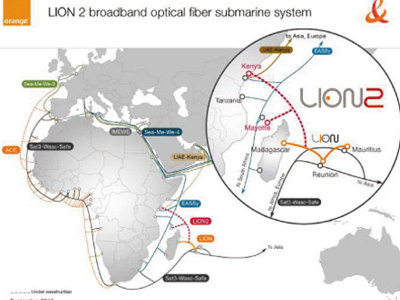

The government said that the second cycle, from 2006 to 2010, placed emphasis on the development of key ICT infrastructure such as fiber optic cable layout.

Speaking at a news conference on Monday evening, the Minister in the Presidency managing ICT Ignace Gatare said, the third phase has been “broadly divided into five areas, ICT skills development, private sector development, ICT for community development, e-Government and cyber security,” which the country hopes will propel the nation into the technological age to compete with other East African nations.

“Under this plan we are looking at improving formal and non-formal education. With the use of fiber optic cable, we want to ensure that there is much of open distance learning in the country,” said Gatare.

He said that the private sector will be instrumental in the third phase, and that government hopes to unveil an electronic payment system to improve mobile finance.

“We also want to take the ICT facilities down to the people by digitalizing all the government programs, increase the tele-centers in the country as well as use of tele-medicine,” Gatare added.

Joseph Mayton