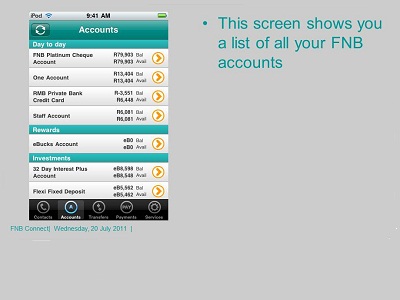

A view of the mobile account screen shot on the FNB app (image source: file photo)

FNB today announced that its customers can now buy FNB Vouchers using Cellphone Banking and send to friends on Facebook. FNB Vouchers on Facebook is another first by a bank in South Africa.

A view of the mobile account screen shot on the FNB app (image source: file photo)

FNB Vouchers are targeted at Facebook users in South Africa. This innovative product enables FNB customers registered for Cellphone Banking to send gifts to their Facebook friends — the recipient of the FNB Voucher can redeem it as Prepaid Airtime or convert it to cash by using the bank’s eWallet service.

CEO of FNB Cellphone Banking Solutions, Ravesh Ramlakan says, “Constant Innovation is what drives us at FNB. It is through innovation that we are able to design and deliver solutions that add convenience to the lives of our customers. FNB Vouchers is such a solution.”

Safety is an important element of this new feature. During the buying process, the customer creates a unique PIN for each voucher. This unique PIN is then used by the customer to post the voucher onto a friend’s Facebook wall. Only Facebook friends with a South African Cellphone number can redeem these vouchers. FNB Cellphone Banking customers can buy these vouchers from R25 – R300, with limit of R1500 per day.

“The face of banking as we know it is continuously changing and as a bank we have seen the benefits of keeping abreast with the move towards the virtual world. With increasing numbers of people joining and using social networks daily, this move was natural for us in terms of extending our reach and customer base,” concludes Ramlakan.

Staff writer